It’s that time of year again – Microsoft have announced their Q4 and full financial year results…so let’s take a look.

Full Year FY24 Results

Revenue = $245.1 billion, a 16% increase

Net Income = $88.1 billion, a 22% increase

Microsoft Cloud = $135 billion +, a 23% increase.

Q4 FY 24 Results

Q4 Revenue = $64.7 billion, a 15% increase

Q4 Net Income = $22 billion, a 10% increase

Microsoft Cloud

This isn’t a Business Unit but rather a group of related products across the organisation including:

- Azure

- O365 Commercial

- Dynamics 365

- Parts of LinkedIn

- “Other cloud properties”

Revenue was $36.8 billion, an increase of 21% Year on Year (YoY).

Microsoft note that gross margin decreased YoY to 69%. This is driven by “sales mix shift to Azure” but was partially offset by Microsoft making Azure improvements including scaling their AI Infrastructure.

Now let’s look at some of the individual Business Units and how they performed in Q4 FY24.

Productivity and Business Processes

Revenue = $20.3 billion, an 11% increase

Office 365 Commercial = 13% increase. Seat growth was again driven by SMB and Frontline Worker growth while Average Revenue Per User (ARPU) growth was driven by E5 and Copilot for M365.

LinkedIn = 10% increase

Dynamics 365 = 19% increase <– This is now almost 90% of all Dynamics revenue.

This gives a good overview of growth over the last 5 quarters:

Intelligent Cloud

Revenue = $28.5 billion, a 19% increase

Azure (and other cloud services) growth was 29% for this quarter, a little drop from the percentage point increase of the last 2 quarters but, as it’s Q4, likely increasing from a higher base. Microsoft highlight that 8 points of this growth was from AI services.

Amy Hood (CFO) states that AI demand is higher than Microsoft’s currently available capacity but they expect availability to increase in H2 FY25 aka Jan 2025 onwards.

Server Products grew by 2% this quarter, again driven by hybrid BYOL use with Azure Hybrid Benefit.

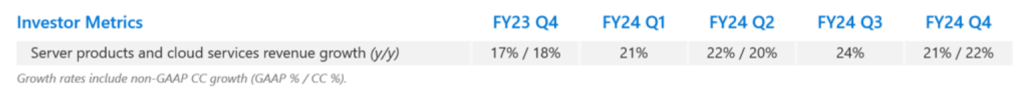

Overall growth over the last 5 quarters looks like this:

Overall business and FY25

In terms of how Microsoft are spending money, Amy Hood, CFO, stated that:

“Cloud and AI related spend represents nearly all of total capital expenditures [CAPEX]. Within that, roughly half is for infrastructure needs where we continue to build and lease datacenters that will support monetization over the next 15 years and beyond. The remaining cloud and AI related spend is primarily for servers, both CPUs and GPUs, to serve customers based on demand signals.”

Amy Hood gave her expectations for Q1 FY25 (and beyond) and they are:

Productivity and Business Processes

Expected revenue growth of between 10% and 11% in constant currency (or $20.3 to $20.6 billion), with O365 driven by E5 and Copilot for M365.

Intelligent Cloud

Expected revenue growth of 18 – 20% (or $28.6 to $28.9 billion) with Azure expected to be 28% – 29% up.

Earnings Call highlights

- 42 mentions of Copilot.

- Number of customers with 10,000+ licenses of Copilot for Microsoft 365 doubled quarter over quarter,

- Industry specific Copilots are here. DAX Copilot for Healthcare (over on the Nuance side of the portfolio) has over 400 customers currently.

- Over 1,000 paying customers of Copilot for Security. Satya Nadella also states they have “1.2 million security customers” <– that indicates a lot of potential growth for Copilot there!

- 60,000+ Open AI customers – with average spend per customer increasing.

- GitHub Copilot accounts for over 40% of GitHub’s revenue and is bigger than GitHub was when Microsoft acquired it.

- 36,000 Azure Arc customers, a 90% YoY increase.

- 14,000+ paying Microsoft Fabric customers.

- 48 million Monthly Active Users of Power Platform, a 40% YoY increase.

- Over 40,000 organisations using Dynamics 365 Business Central.

- Over 3 million users of Teams Premium.

- More large-scale SAP workloads being migrated to Azure.

- There was further growth in the “number of 10-million-dollar-plus and 100-million-dollar-plus contracts for both Azure and Microsoft 365“