Microsoft Financial Results for Q2 FY26

Revenue = $81.3 billion (up 17%)

Net Income = $38.5 billion (up 60%)

Microsoft Cloud = $51.5 billion

As it has been every quarter for many years now, more big increases across the board as Microsoft continues to grow. They have RPO (Remaining Performance Obligation) of $625 billion, an increase of 110%, which indicates a lot of multi-year agreements have been signed. This huge backlog of guaranteed revenue likely means that Microsoft aren’t as bothered about your order/renewal as you might like them to be…making discounts harder to come by for many customers.

Is AI still a hot topic?

Yes!

Satya Nadella, Microsoft CEO said:

“We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises”

“We are pushing the frontier across our entire AI stack to drive new value for our customers and partners.”

And devoted the majority of his time on the earnings call to discussing AI, both software and hardware.

Additionally, Q2 saw commercial booking increase 230%, “driven by Azure commitments from OpenAI and Anthropic”. Further more, Perplexity have also signed a $750 million deal with Azure – https://www.msn.com/en-us/money/other/perplexity-inks-microsoft-ai-cloud-deal-amid-dispute-with-amazon/

Productivity & Business Processes

Revenue = $51.5 billion, an increase of 26%

Dynamics 365 revenue increased 19%

Microsoft 365 Commercial cloud revenue increased 17% with ARPU (Average Revenue Per User) driven by E5 and M365 Copilot.

Microsoft 365 Copilot seats added increased 160% year on year in FY26 Q2 (Oct – Dec 2025) taking them to 15 million paid seats. Of course, how many of those are being used – and being used well – is a different question entirely.

Tracking and understanding ROI of AI investments isn’t as high a priority for most organisations as it should be. This really is an areas where ITAM & FinOps professionals can help organisations take a deeper, more data driven approach to AI procurement and value. I wrote this over 2.5 years ago – https://cloudywithachanceoflicensing.com/2023/07/21/microsoft-365-copilot-pricing-and-licensing-strategy/ – and I don’t think much has changed tbh.

Intelligent Cloud

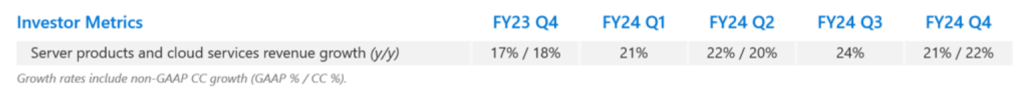

Revenue = $32.9 billion, an increase of 29%

Azure increased by 39% (down from 40% in the previous quarter) but gross margin on cloud declined slightly. Market analysts were hoping for higher Azure growth so this perceived miss was partially responsible for a drop in Microsoft’s stock after the announcement.

They are also concerned that the huge amount of money Microsoft are spending on CAPEX related to AI datacentres etc. isn’t generating ROI fast enough.

Conclusion

Microsoft’s results underscore that licence management, cloud cost control, and financial governance are now inseparable, particularly as AI accelerates both consumption and complexity.

For ITAM and FinOps leaders, Q2 FY26 is less about Microsoft’s growth and more about the operational response it demands: proactive review of AI and cloud commitments, tighter contract scrutiny, and implementation of usage intelligence.

Organisations that align ITAM and FinOps processes to anticipate consumption variability and optimise spend can mitigate financial risk while maximising value from licences, cloud services, and emerging AI capabilities. Success will increasingly depend on granular monitoring, AI-informed analytics, and governance tools that bridge licensing, cloud, and financial metrics.

See more here – FY26 Q2 – Press Releases – Investor Relations – Microsoft